No charts to or data to back it up, but if I feel so inclined I may attempt a back test to substantiate the statement from a revered CNBC analyst, "The Last trading day historically is usually down; and conversely the First trading day is usually up".

Buy on close today and Sell on close Friday.

Happy New Year's

Blog description

- Rodney

- A place for friends to gather and view stock market charts, discuss technical analysis and market outlook. What is your Principal Asset? How can it be developed? Each and all should do their own due dilligence and homework before investing. And by no means should you use anything I say or show here as a sole basis to buy or sell securities as everything is for educational experience only.

Wednesday, December 31, 2008

Wednesday, December 17, 2008

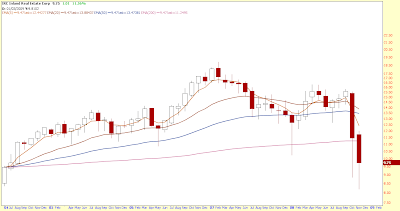

MET Life...... Update

Doesn't this stock stuff look EZ?

It's fairly obvious where the price resistance is going to be going forward. Question is how to protect your gains? If you are able - sell Calls; if not buy six month out PUTS. Basically, one could use the bottom of this recent shoulder and the Target area as a price range to trade around. Buy PUTS at the top of the range - take profits on Puts at the bottom of the range and use all profits to BUY more common shares.

It's fairly obvious where the price resistance is going to be going forward. Question is how to protect your gains? If you are able - sell Calls; if not buy six month out PUTS. Basically, one could use the bottom of this recent shoulder and the Target area as a price range to trade around. Buy PUTS at the top of the range - take profits on Puts at the bottom of the range and use all profits to BUY more common shares.

It's fairly obvious where the price resistance is going to be going forward. Question is how to protect your gains? If you are able - sell Calls; if not buy six month out PUTS. Basically, one could use the bottom of this recent shoulder and the Target area as a price range to trade around. Buy PUTS at the top of the range - take profits on Puts at the bottom of the range and use all profits to BUY more common shares.

It's fairly obvious where the price resistance is going to be going forward. Question is how to protect your gains? If you are able - sell Calls; if not buy six month out PUTS. Basically, one could use the bottom of this recent shoulder and the Target area as a price range to trade around. Buy PUTS at the top of the range - take profits on Puts at the bottom of the range and use all profits to BUY more common shares.

Saturday, December 13, 2008

Thursday, December 4, 2008

Up for now.....

Is the bottom in? Well isn't that a question worth pondering? Not really.....

So 7,449 on the DOW 30 or $INDU is the bottom for now. So be it. Bottom line is 8,800 presents the tell tale line for the bull run of Obama 2009. Another could be Crude Oil per barrel bouncing off of LONG term 200 Month average of $45.08 per barrel.

So 7,449 on the DOW 30 or $INDU is the bottom for now. So be it. Bottom line is 8,800 presents the tell tale line for the bull run of Obama 2009. Another could be Crude Oil per barrel bouncing off of LONG term 200 Month average of $45.08 per barrel.

Mere coincidence.....I think not.

So 7,449 on the DOW 30 or $INDU is the bottom for now. So be it. Bottom line is 8,800 presents the tell tale line for the bull run of Obama 2009. Another could be Crude Oil per barrel bouncing off of LONG term 200 Month average of $45.08 per barrel.

So 7,449 on the DOW 30 or $INDU is the bottom for now. So be it. Bottom line is 8,800 presents the tell tale line for the bull run of Obama 2009. Another could be Crude Oil per barrel bouncing off of LONG term 200 Month average of $45.08 per barrel.Mere coincidence.....I think not.

Tuesday, December 2, 2008

MET Life......

Let's take a look at MET Life...

The long term monthly chart depicts the absolute crushing this stock has taken in the recent recession, but a look at the 60 day/60 minute bar chart below gives the glimmer of HOPE...

Bottom-line is if you've held through the recent downturn there is absolutely no reason to sell now. The $40 target may be a time to take "some" off the table, but I would do this only to reload for the eventual higher push back into the 60's.

Bottom-line is if you've held through the recent downturn there is absolutely no reason to sell now. The $40 target may be a time to take "some" off the table, but I would do this only to reload for the eventual higher push back into the 60's.

The long term monthly chart depicts the absolute crushing this stock has taken in the recent recession, but a look at the 60 day/60 minute bar chart below gives the glimmer of HOPE...

Bottom-line is if you've held through the recent downturn there is absolutely no reason to sell now. The $40 target may be a time to take "some" off the table, but I would do this only to reload for the eventual higher push back into the 60's.

Bottom-line is if you've held through the recent downturn there is absolutely no reason to sell now. The $40 target may be a time to take "some" off the table, but I would do this only to reload for the eventual higher push back into the 60's.Perhaps a purchase of some $30 PUTS when the $40 target is hit to safeguard shares. And then buy more common with the gains from the PUTS?

Sunday, November 30, 2008

Dividend yield scan - 1 week results

Friday, November 21, 2008

Divididend yield scan....

Okay, so heres the scan criteria:

Price >= $5

Price <= $100

Average Daily Volume >= 250,000 shares

Dividend Yield >= 10%

Price/Earnings Ratio >= 8

Price >= $5

Price <= $100

Average Daily Volume >= 250,000 shares

Dividend Yield >= 10%

Price/Earnings Ratio >= 8

Anyway, I thought you would find this info helpful and enlightening setting up for some long term purchases. My plan is to glean out at least 5 of these.

Currently without even doing perfunctionary research I like: BAC, SNH, ADSK, NAT, CRY, NNN, PPL, OHI. This group alone covers Electric power, banking, software, biotech, healthcare, commercial retail space real estate, senior assisted living real estate, & tanker cargo shipping.

Tuesday, November 18, 2008

Is this the bottom for commodities?

Friday, November 14, 2008

Wednesday, November 12, 2008

Tuesday, November 11, 2008

MR. Softy....

Long term monthly chart of MSFT... Check out all the white space below $17.13...

5 year monthly.... MASSIVE H&S pattern

5 year monthly.... MASSIVE H&S pattern

5 Yr Weekly

5 year monthly.... MASSIVE H&S pattern

5 year monthly.... MASSIVE H&S pattern

5 Yr Weekly

- At $20.71 there is some extreme support which is weakening with each failed attempt to break below. A break would fulfill the H&S pattern and a projected target below would be $36.95-$20.71 = $16.24.

- Another bounce off of $20.71 which will ultimately fail at the 23.6% fib line or $24.54 and then finally break the $20.71 level.

Either way Mr. Softy will eventually provide a nice short opportunity

Monday, November 10, 2008

Sunday, November 9, 2008

Subscribe to:

Comments (Atom)