Blog description

- Rodney

- A place for friends to gather and view stock market charts, discuss technical analysis and market outlook. What is your Principal Asset? How can it be developed? Each and all should do their own due dilligence and homework before investing. And by no means should you use anything I say or show here as a sole basis to buy or sell securities as everything is for educational experience only.

Monday, July 11, 2011

Friday, July 8, 2011

Thursday, July 7, 2011

Tuesday, July 5, 2011

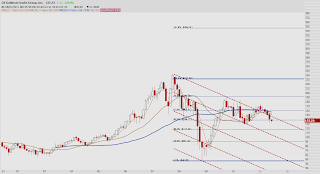

$SPX

Broke out Friday, but will it have legs? Would not be surprised to see retracement back to red line and eventual breakdown over next month.

Thursday, June 30, 2011

Friday, June 24, 2011

CMG - Call of the year

Made the long call back on January 30,2011 to watch the pennant move on Chipotle Mexican grill at $211.89 with a taget of $300. Topped out at $295.99 the last wek of May.

Thursday, June 23, 2011

EUR/USD

Fed bullish on the Dollar? I don't think so; too many baby boomer t-Bills out there not worth redeeming. The unsaid fleecing of American wealth.

Monday, June 20, 2011

Sunday, June 19, 2011

Tuesday, June 14, 2011

Saturday, May 21, 2011

Wednesday, May 11, 2011

Friday, May 6, 2011

GMCR - update

I think I called this launch and I have not moved the technicals... This is now the current range for more consolodation until the punch through to new highs.

Wednesday, April 27, 2011

Crude & Gasoline Futures - Weekly

Just a pause and still amazing how the terrorist have driven up gasoline in comparison to the actual cost of oil. I wonder how much of that Futures money is Republican money? Yet another piece of the bull**** not truly covered by the media. Wouldn't it be nice to know who is REALLY behind this non-substantive fake demand?

GMCR

Topping or ready to launch to $75?

At the money Jan 12 Calls & Puts $10 per contract. Would be nice to be able to sell $80 calls to pay for part of $65 Calls. However a break below $63 could pick up steam quickly.

$VIX

The price of Options continues to get cheaper making those long Calls worth less and the Puts cheaper to purchase. Could be a good time to get some Long Calls on future implied volotivity.

In the money Oct 11 Calls going for $7.75 per contract

$SPX

If the market were a wrestler he'd be called for stalling in 2011...

Pretty simple technical read form here:

Breakout above 1360

Breakdown below 1250

May be 2012 till we know the answer.

Thursday, April 14, 2011

$VIX

Options are cheap and if you have the ability to sell them straddle plays could work as the lack of volativity wanes on for the rest of the year.

SLV

WOW! I hope you held some. Precious metals will continue to go up until inflation is real and the FED has to raise rates. That will be no time soon as they will continue to flood the market with cash raising the deficit exponentially.

Friday, April 1, 2011

Monday, March 14, 2011

Tuesday, March 8, 2011

Subscribe to:

Posts (Atom)